Investing Roulette

I recently visited Las Vegas for my future brother-in-law's bachelor party. While we spent most of the time eating and hanging out by the pool, we of course explored the casinos. I'm happy to say I came home with $4 more than when I left, so overall it was a success!

When browsing the casino at the Aria Resort, I stopped by the Roulette table to observe. On the screen at the head of the table, they had a display showing the table's "hot" numbers (numbers and colors that have won above average that evening) and the "cold" numbers (numbers and colors that have won below average that evening).

Perhaps these mean nothing to the "professional" Roulette player, but to the casual gambler, he/she may try to use these recent outcomes to determine their next bet.

The house always wins.

Of course, we all know how this ends most of the time. While there are exceptions, in the long run, the house always wins. Using "hot" numbers every time usually doesn't result in consistent winnings for the player.

And unfortunately, people often use this same strategy when it comes to investing. They'll look at stocks that have recently performed really well, like Tesla or Apple, then try to get it on the action. It's assumed that those big companies will continue to perform as they have over the past 10 years.

But what does the data actually tell us?

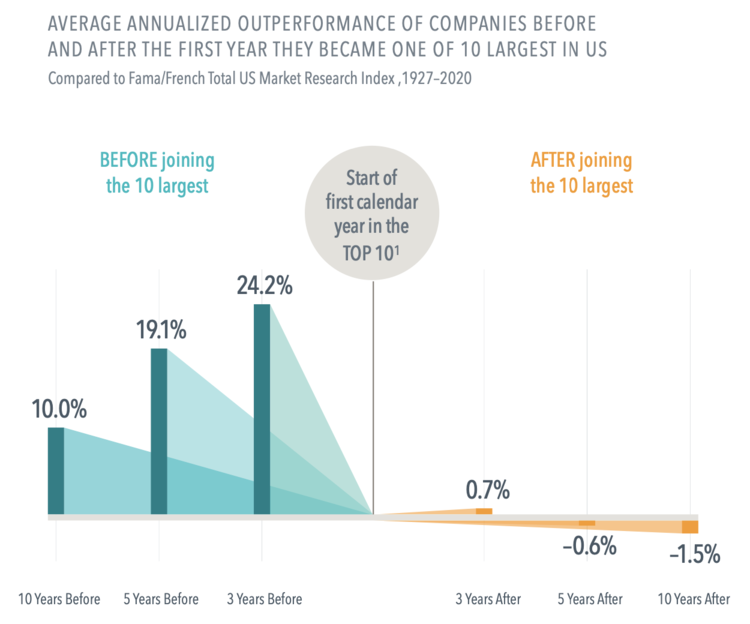

Let's look at the stock market data from 1927 - 2020 to see how individual stocks have performed during the years before they became one of the 10 largest companies (by market cap), compared to how those same companies performed in the following years after they entered the top 10.

[Source: Dimensional Fund Advisors]

As you can see, the average annual return for these stocks outperformed the market by 24.2% per year, for the 3 years leading up to them joining the top 10. However, the following 3 years, those companies (on average) only beat the market by 0.7%!

It gets even worse.

During the following 5 years, those companies underperformed the overall market by 0.6%. After 10 years, those companies were underperforming the market by 1.5%. Meaning, their incredible performance from 10 years prior didn't continue once they reached the top 10.

Moral of the story: Don't simply chase the winners.

That's not to say that winners (like Apple and Microsoft) will never continue to outperform the market, but if your entire strategy is simply chasing those stocks that performed really well last year, it likely won't work out for you in the long-run.

So you may be asking "Who are the top 10 today?"

Apple

Microsoft

Amazon

Alphabet (Google)

Facebook

Berkshire Hathaway

Tesla

Visa

JPMorgan Chase

Johnson & Johnson

In the end, the most prudent approach is a broadly diversified strategy that not only includes these companies, but also includes thousands of other companies. This would include smaller companies that are in the early growth stages (i.e. Apple before they were "Apple").

That way, when these companies do take off during the 10 years prior to making it in the top 10, you get the reward, as opposed to chasing that return after the fact.